Investors are embracing infrastructure assets like never before. In 2018, they look likely to set a record for unlisted infrastructure fundraising at the time of writing.1 Why? Infrastructure assets can offer relatively high yields that investors with regular income needs, such as insurance companies and pension funds, find difficult to come by in today’s persistently low-interest rate environment.

Investors are finding a plethora of opportunities, as the private sector steps in to fill a funding gap left by governments. Europe, where we invest, needs €2 trillion of investment in infrastructure by 2020 just to stay competitive, according to estimates by the European Commission. In straitened economic times, this is a bill that most governments simply cannot afford.

Europe’s infrastructure needs renewal, but in ways that are sustainable over the long term. For example, ports are being upgraded to make supply chains more effective, ensuring that goods can move around the world more efficiently. These modernisations will improve the capacity of ports and mean that customers receive better service. Conversely, the need to meet a new, stricter cap on sulphur in marine fuel could force down port revenues as shippers may start negotiating harder on price. An ever-changing landscape means that infrastructure investors must weigh up opportunities and challenges carefully.

In many ways, this growing emphasis on sustainability and new technology represents a new age of infrastructure investing. Investors are more focused on environmental, social and governance (ESG) issues than ever before. We think that ESG and infrastructure investment are a natural fit. Much of Europe’s ageing infrastructure needs renewing to ensure it is sustainable.

When investing in infrastructure, we believe it is important to take a long-term view, to build projects that are sustainable and ecologically responsible, and to be prepared to continually make improvements. Ultimately, this will result in better returns and lower risk, as politicians and regulators are much less likely to intervene.

Powered by sustainability and technology

2019 looks likely to be another year of impressive growth for infrastructure as it enters a new age, driven by technological disruption and the growing importance of sustainability. As investors, we think it is important to select from the right set of opportunities. Instead of joining the queue of competitors who are keen to participate in high-profile mega deals, we are looking to the mid-market, where there are more prospects which often offer better value and less competition.

Sustainability is an increasingly important theme. In recent years, there has been enormous growth in renewable energy infrastructure, notably solar parks and wind farms. The pace of change has been so rapid that power grids have not necessarily kept up: even more opportunities will arise in this area as it develops. Around 30% of Infrastructure investments are in renewable sources.2 Smart cities are much talked about; when they are realised, they will be powered by smart, technology-enabled infrastructure.

Energy distribution generally is becoming more efficient. District heating, for example, has traditionally been fuelled by gas or oil; these days, alternative sources like water and hydrogen are getting more popular, as is biomass heating. As these systems are upgraded, they will create opportunities for investor

Technology’s role in making infrastructure more efficient is also likely to grow in 2019. This means that, for instance, water utility companies can now hover a scanner over an area and see if there is a leak, where in the past they would have had to dig a hole to locate the problem.

Balancing risk and reward

There is a popular narrative that infrastructure is predictable and stable. But it can only offer these characteristics if it is carefully managed. Myriad return drivers fuel infrastructure, and various risk factors could have different effects on different types of infrastructure.

Political and regulatory change can also impact infrastructure’s potential returns. For instance, the International Maritime Organisation has introduced a 0.5% cap on sulphur, with which all ships must comply by 2020. This will have seismic implications for how ships are fuelled, and shipping and trade patterns more broadly.

Looking to 2019, it is more important than ever for investors to take a long-term view but also be prepared to follow policy and regulatory developments closely. Long-term asset owners with a commitment to sustainability are much more likely to have the ear of regulators and government than those who are only driven by short-term profit.

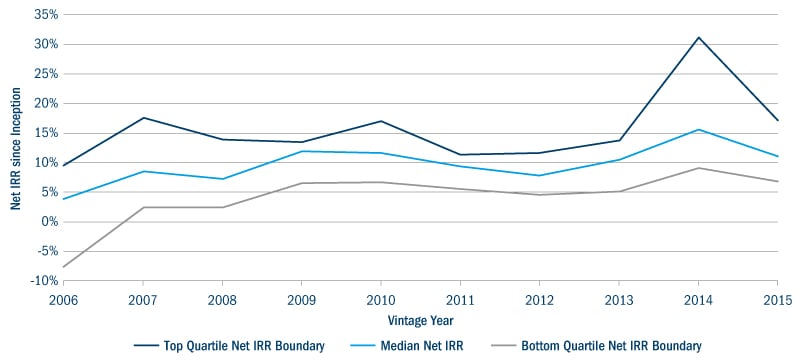

Unlisted Infrastructure: Median Net IRRs and Quartile Boundaries by Vintage Year

Source: Pregin 2018.

If a manager buys a host of infrastructure assets in a particular period, they are vulnerable to vintage risk, ie, the risk of buying assets at a particular point in the cycle and then struggling to sell them at a different stage when prices are lower. As the chart above illustrates, infrastructure does not move in a straight line: there are zig zags in performance. For that reason, a long-term view is key to sustained growth over time.